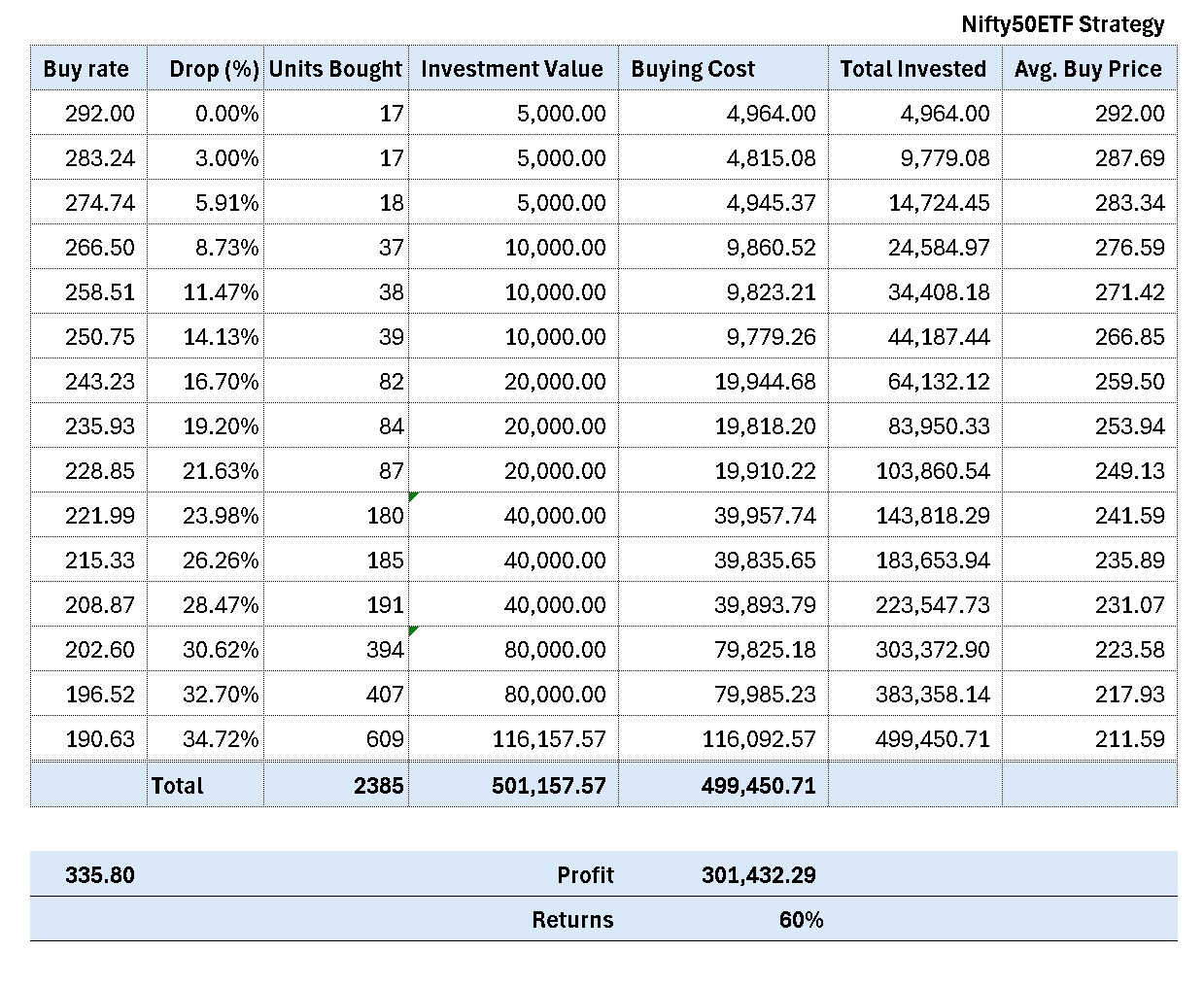

Investing in Nifty50 Exchange Traded Funds (ETFs) such as NiftyBEES requires a well-defined strategy to maximize returns while minimizing risks. Nifty50ETF strategy, as shown in the table, follows a disciplined approach to buying NiftyBEES every time the Nifty50 index drops by 3%. This systematic approach takes advantage of market corrections and enhances long-term profitability.

Understanding the Strategy

The core principle behind this investment strategy is to buy NiftyBEES at predetermined intervals whenever the market declines by 3% from the previous buy level. This systematic investment ensures that capital is allocated more efficiently, and additional units are purchased at progressively lower prices, thereby reducing the overall average cost per unit.

Key Elements of the Strategy

- Buying in Phases: Instead of investing a lump sum amount at once, the investor purchases units in multiple stages based on the Nifty50 index’s decline.

- Capital Allocation: The investment starts with small amounts and gradually increases as the market drops further, ensuring higher exposure at lower prices.

- Average Buy Price Optimization: As more units are acquired at lower prices, the average buy price continues to decrease, improving future profitability.

- Disciplined Execution: The investor adheres to a strict plan, buying additional units only when the index meets the predefined 3% drop condition.

Investment Breakdown

The table provides a detailed account of how investments are made at each stage of the market decline.

Step-by-Step Investment Process

- Initial Investment at ₹292.00:

- 17 units were bought for ₹5,000, marking the start of the investment.

- As no decline occurred yet, this was the highest buy price.

- Subsequent Investments with Market Drops:

- When the Nifty50 dropped 3% to ₹283.24, another 17 units were bought.

- With a further 5.91% decline, 18 more units were purchased at ₹274.74.

- The trend continued with additional purchases as the market dropped by 8.73%, 11.47%, 14.13%, and so on.

- Larger Allocations at Lower Prices:

- As the market fell further, the number of units bought increased significantly.

- At a 34.72% decline (₹190.63), the largest purchase was made, acquiring 609 units worth ₹116,157.57.

- This ensured that the average buy price was reduced to ₹211.56.

Final Investment Outcome

- Total Amount Invested: ₹500,000

- Total Units Bought: 2,385

- Final Average Buy Price: ₹211.56

- Current Market Price (Assumed for Profit Calculation): ₹335.80

- Total Portfolio Value: ₹800,883

- Total Profit: ₹300,883

- Total Returns: 60%

This strategy proved highly profitable as the market recovered, demonstrating the effectiveness of systematic investment when the market is volatile.

You can download the xl sheet here.

Why This Strategy Works?

- Capitalizing on Market Corrections:

- Instead of fearing market dips, this approach takes advantage of them by buying more at lower prices.

- Rupee Cost Averaging:

- Since purchases are made at different price points, the overall average price remains lower than a one-time lump sum investment.

- Discipline Over Emotion:

- Many investors panic during downturns, leading to poor decisions. This method ensures rational investment choices.

- Higher Exposure at Lower Valuations:

- By increasing the number of units purchased as the price drops, the investor positions themselves for greater gains when the market rebounds.

Conclusion

Nifty50ETF strategy is a well-structured and disciplined investment method designed for long-term wealth creation. By systematically buying NiftyBEES on every 3% market drop, the investor reduces risk, lowers the average purchase price, and maximizes returns when the market recovers.

This approach is ideal for investors who want to take advantage of market volatility without trying to time the market manually. It offers a balance of risk management and high returns, making it a powerful strategy for ETF investors.

Would you like assistance in implementing this strategy or tracking its performance? Let me know how I can help!

Disclaimer

The information provided on this blog is for educational purposes only. The views expressed here are based on personal research and opinions and are not intended to be professional financial, legal, or investment advice. Always consult with a qualified professional or financial advisor before making any significant decisions related to investments, finance, or legal matters.

We make no guarantees about the accuracy, completeness, or reliability of the information presented, and we are not responsible for any losses, damages, or consequences arising from the use of this content.

The content of this blog is subject to change without notice, and we do not endorse or promote any specific products, services, or investments. By reading this blog, you agree to assume full responsibility for your actions and decisions.